cryptocurrency tax calculator uk

Calculating your crypto taxes and figuring out the numbers you must report to HMRC can seem like an overwhelming task for most. For companies profits or losses from cryptocurrency trading are part of the trading profit rather.

11 Best Crypto Tax Calculators To Check Out

In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax.

. For individuals income tax supersedes capital gains tax and applies to profits. Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically. When to check.

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios such as DeFi loans DEX transactions gas fees leveraged. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. If you owned it for more then a year youll pay the long-term rate which is lower.

You can cash in or give. Free UK calculator tool. Capital Gains Tax is a tax you pay on your profits.

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Check if you need to pay tax when you receive cryptoassets. Simply connect your accounts and let CoinLedger calculate your gains and losses across all of your transactions.

In our Guide To Tax on Cryptocurrency UK well explain the tax rules around cryptocurrency trading as a business. Check if you need to pay tax when you sell cryptoassets. What is a tax on cryptocurrency.

Use your tokens to pay for. This is useful in making sure the asset symbol you are using in your transaction records is the correct one. Use our crypto tax calculator below to.

You might need to pay Capital Gains Tax when you. To calculate your capital gains as an. You can estimate what your tax.

You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. How to calculate crypto taxes in the UK.

Use our free crypto tax calculator to help evaluate how much tax you might pay on crypto you sold spent or exchanged. Bittytax_price latest ETH 05 1 ETH007424 BTC via CryptoCompare Ethereum. This means you can get your books.

You simply import all your transaction history and export your report. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. Exchange your tokens for a different type of cryptoasset.

If you held it for a year or less youll pay the short-term rate. It helps you calculate your capital gains using Share Pooling in accordance. Youll then need to file and pay your Capital.

You declare anything youve earned from selling an asset over a certain threshold via a tax return. Koinly helps UK citizens calculate their crypto capital gains. Once youre done importing you can generate a comprehensive crypto tax.

The Best Crypto Tax Software Of 2022 Ranked Reviewed

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

11 Best Crypto Tax Calculators To Check Out

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Calculating Crypto Taxes In Uk W Share Pooling Koinly

Crypto Tax Uk Ultimate Guide 2022 Koinly

11 Best Crypto Tax Calculators To Check Out

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

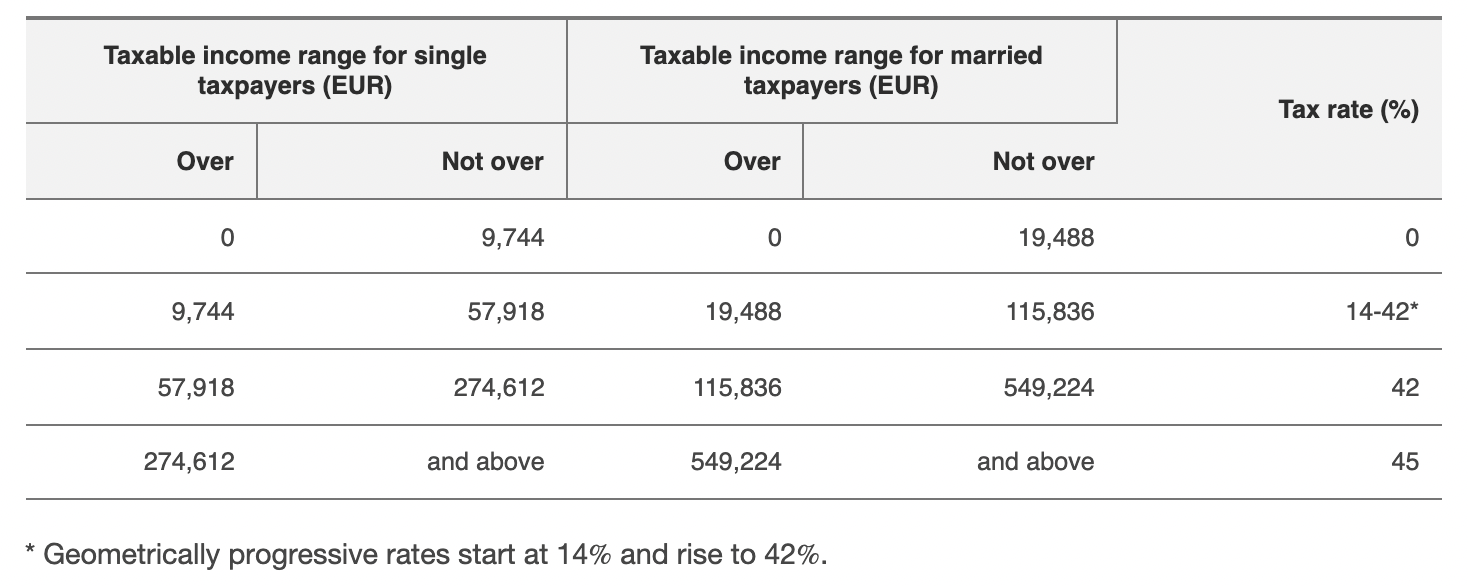

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Crypto Tax Uk Ultimate Guide 2022 Koinly

How To Calculate Your Uk Crypto Tax

:max_bytes(150000):strip_icc()/GettyImages-649719504-62b7bc84aa6c47a7ba6c985cd65a8e4e.jpg)